GoCardless

GoCardless : Reviews, Pricing, Features & AlternativesGoCardless is an Online Payment Software. Price : $0 (free trial available). Review GoCardless : Overview & Pricing

GoCardless Overview : Features, Pricing, Reviews & Alternatives

GoCardless is an Online Payment Software intended for businesses. Let’s discover user reviews, features and prices of this business app.

GoCardless is listed as a Online Payment Software and Payment Processing Software for companies and is used for Payment Processing, Billing and Invoicing, Recurring Billing …

GoCardless price starts from $ 0,01 per user and per month (free trial available).

Get paid on time, every time with GoCardless. We allow organizations to accept recurring payments in the way that suits them best and at any time

A business with recurring income, get paid with Gocardless

The UK’s leading online direct debit provider

What is GoCardless ?

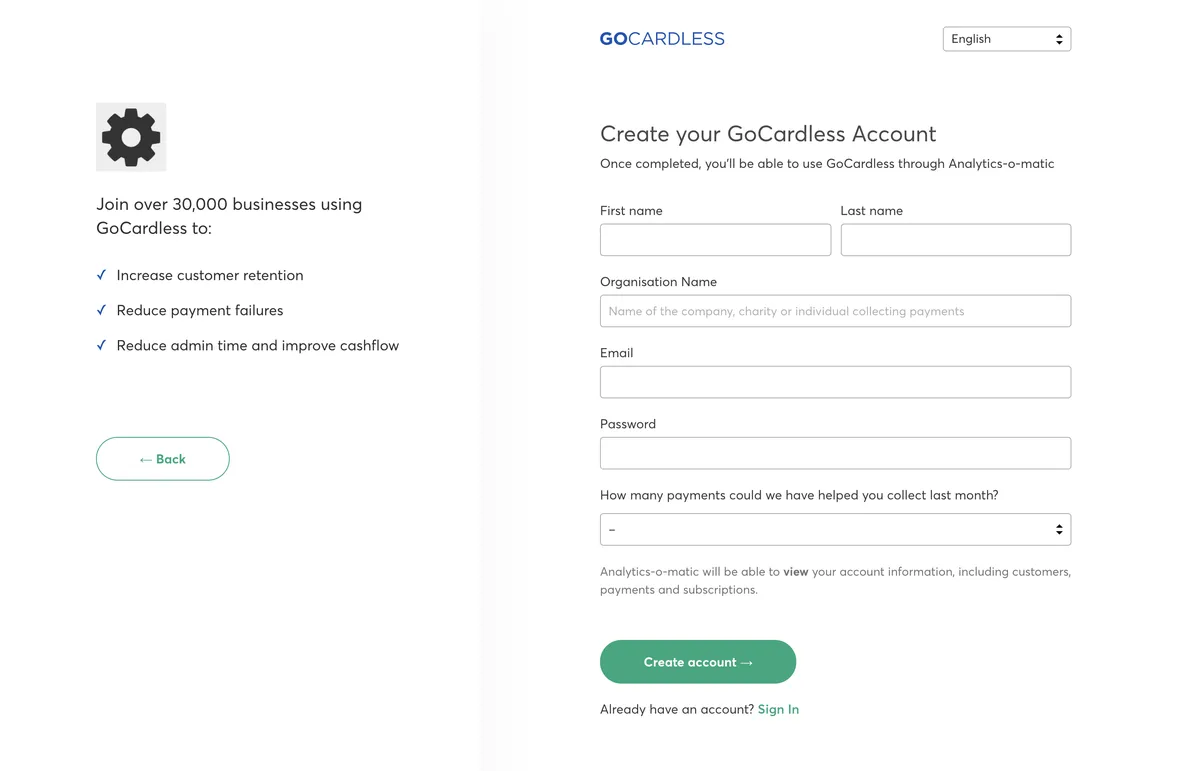

GoCardless is a payment processing software with a RESTful API that allows easy integration with few resources and seamless integration with your business. It’s premium, has a configurable checkout flow, and is easy to integrate into your website. Supports more than 30 countries with predefined payment flows and automatic alerts. You can create custom recurring payment plans tailored to your business with GoCardless. You can accept direct debit payments on your website or by providing a secure payment link to your customers. Your customers only need to enter their payment information once, securely, and then you can collect one-time or recurring payments when they’re due. With the GoCardless dashboard, you can effortlessly renew, modify and pause payment plans while getting full visibility into every transaction. You can now accept payments from consumers around the world, including the UK, Eurozone countries, the US, Canada and Australia.

GoCardless makes it super easy for businesses to make regular online payments directly from their customers’ bank accounts, perfect for recurring billing and subscriptions.

GoCardless makes direct debit collection easy for everyone, from individuals to multinational corporations.

GoCardless allows businesses to make regular online payments directly from their customers’ bank accounts, perfect for recurring billing and subscriptions.

GoCinchy is a SaaS-based social media marketing solution.

Online payment solutions are expensive and take time to implement. This is what GoCardless wants to change. GoCardless ( is a new type of payment provider. We offer an online direct debit solution, easily accessible and at competitive rates. Our standard commission of 1% (with a cap of Û2), the dematerialization of mandates, access to a The user interface and the ability to reconcile payments in an instant make GoCardless the preferred solution for merchants Thanks to our team of engineers and payment specialists, GoCardless is growing exponentially Knowledge of the banking system and the needs of our customers make GoCardless the benchmark for recurring payment collection We are sponsored by Barclays, regulated by the Financial Conduct Authority and based in Paris, London, Berlin and Madrid.

Online payment solutions are expensive and take time to implement. This is what GoCardless wants to change. GoCardless ( is a new type of payment provider. We offer an online direct debit solution, easily accessible and at competitive rates. Our standard commission of 1% (with a cap of Û2), the dematerialization of mandates, access to a The user interface and the ability to reconcile payments in an instant make GoCardless the preferred solution for merchants Thanks to our team of engineers and payment specialists, GoCardless is growing exponentially Knowledge of the banking system and the needs of our customers make GoCardless the benchmark for recurring payment collection We are sponsored by Barclays, regulated by the Financial Conduct Authority and based in Paris, London, Berlin and Madrid.

GoCardless Review : Pros & Cons

Pros & Cons

When it comes to finding the right Online Payment tools to manage your business, you have too many options – and they all come with their strengths and weaknesses.

One such familiar name in this arena is GoCardless, and as you may have guessed from the title, this review will tell you more about GoCardless’s pros and cons.

Weighing the pros & cons is essential before selecting this tool for your business and your team.

GoCardless Pros : Key Benefits

– Your brand in front of your customers:

– Transform your customer experience:

– Fully white labeled for complete brand authenticity with GoCardless Pro.

– Collect payments across Europe:

– Let customers pay on the date and time that suits them best.

– Low and transparent rates:

– No setup costs, no hidden fees, no tie-in requirements, and no minimum terms.

– Process direct debit payments for Bacs, SEPA and Autogiro through a single integration.

– Reduce administration:

– Easy setup and migration:

GoCardless Cons

– Con : Custom integrations can come at a price.

GoCardless Features

Here is the list of the main features of this computer software :

– 24/7 accessibility

– Automation of actions

– Import – Export data

– Contact management

– Personalization

– Customer management

– Payment management

– Online payment management

– Credit card payment management

– API

– Accounting Integration

– Alerts/Notifications

– Billing & Invoicing

– Customizable Branding

– Electronic Payments

– Multi-Currency

– Online Payments

– Payment Processing

– Payment Processing Services Integration

– Project Billing

Main function & Pro Features

– Recurring/Subscription Billing

– Reporting/Analytics

– Search/Filter

– Status Tracking

– Transaction History

– Online payment

– Anti-fraud controls

– API, Web service

– Fully customizable integration

– Decreased churn

– Improved conversion rate

– Improved cash flow

– Payment collection

– Account creation in minutes

– Customer database import

– Save administrative time

– Automate collection of payments

GoCardless Integrations

GoCardless integrates with more than 29 applications & plugins like VeryConnect, Chargebee and Clear Books (…) : database connection, synchronize data, share files (…) to improve your workflow and increase your productivity !

It also provides a powerful API toolkit that allows developers to build web services and exchange data.

Top 20 GoCardless integrations

– Xero

– Jotform

– QuickBooks Online Advanced

– Synder

– Pabau

– Class Manager

– Glofox

– Better Proposals

– Invoice Ninja

– TeamUp

– TutorCruncher

– GymMaster

– ToucanTech

– ERPNext

– Workbooks

– White Fuse

– ClubWorx

– Recurly

– KashFlow

– Beacon

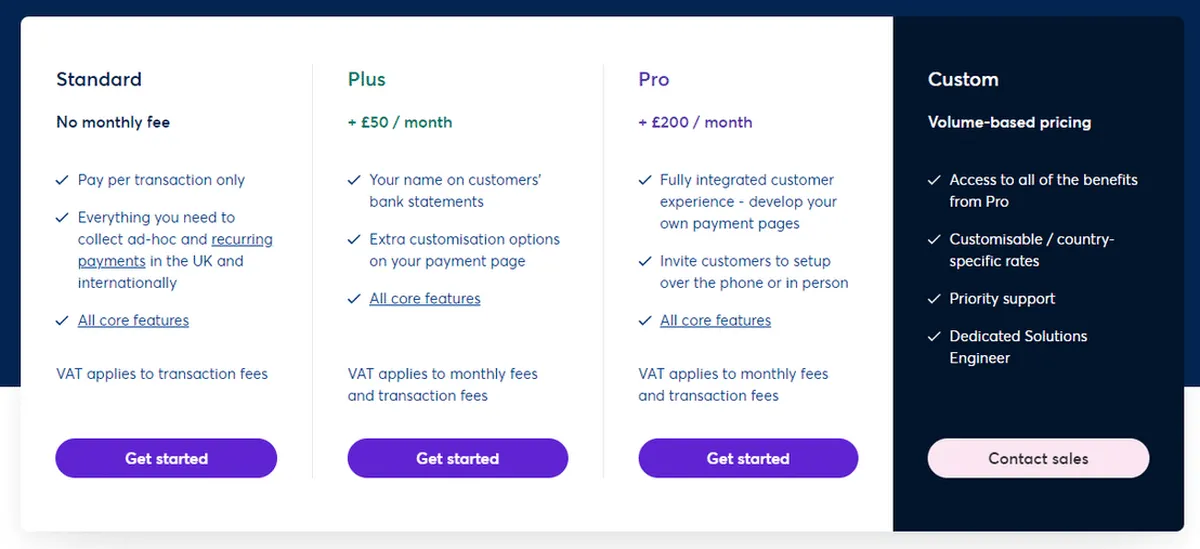

GoCardless Pricing

The GoCardless pricing plan starts from $ 0,01 per month and per user, but this price is likely to change because different options are offered by the developer : number of licenses, additional functions, add-ons, bundles …

GoCardless offers several pricing plans :

– Standard : $ 0,01 per user / per month

– More : –

– Pro : –

– Custom : –

– Premium : –

| Standard | More | Pro | Custom | Premium |

| $0,01 | – | – | – | – |

| Per month | Per month | Per month | Per month | Per month |

| Per user | Per user | Per user | Per user | Per user |

Save $$$ on SaaS and on-premise Software Subscriptions to help your create, grow and scale your business : annual billing usually is cheaper than monthly billing and you can expect 10% to 20% discount.

Sign up for a trial and start using it right away !

Free trials usually are time limited or feature limited but this is a good way to ensure it is the right option for your business before making a purchase.

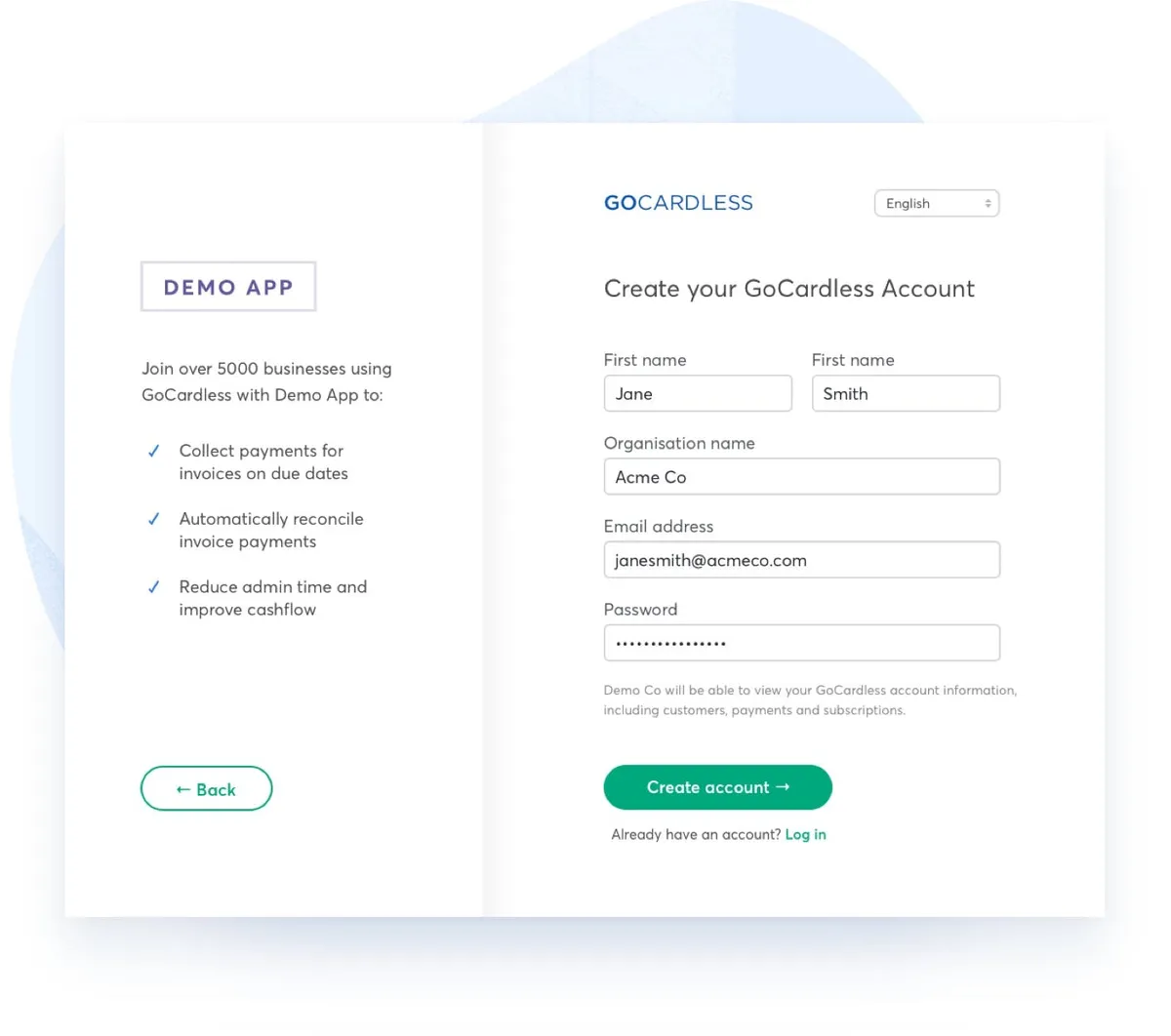

Screenshot of the Vendor Pricing Page :

GoCardless Pricing Plans

Pricing Details

Pricing Model : Subscription

Free trial : Available

Free plan : Yes

Freemium : Freemium

Starting price : $ 0,01

Entry-level set up fee : No setup fee

The pricing details were last updated this year from the vendor website or retrieved from publicly accessible pricing materials and may be different from actual. Please confirm pricing and deals with the vendor website before purchasing.

Deployment & Setup

GoCardless is a cloud-based Online Payment platform : its infrastructure is hosted in the United States (probably on AWS, Microsoft Azure or Google Cloud Platform).

gocardless is a SaaS (Software as a Service) / web application : a web browser on a computer is required for full functionality of features and manage dashboard.

It supports desktop operating systems (like Windows and Mac OS …).

Technical Details & Specifications

Deployment : Cloud / SaaS

Desktop Operating Systems : Windows / Mac OS / Linux …

Mobile Platforms : –

Native Apps / Mobile Applications : –

GDPR compliance : No information

Supported languages

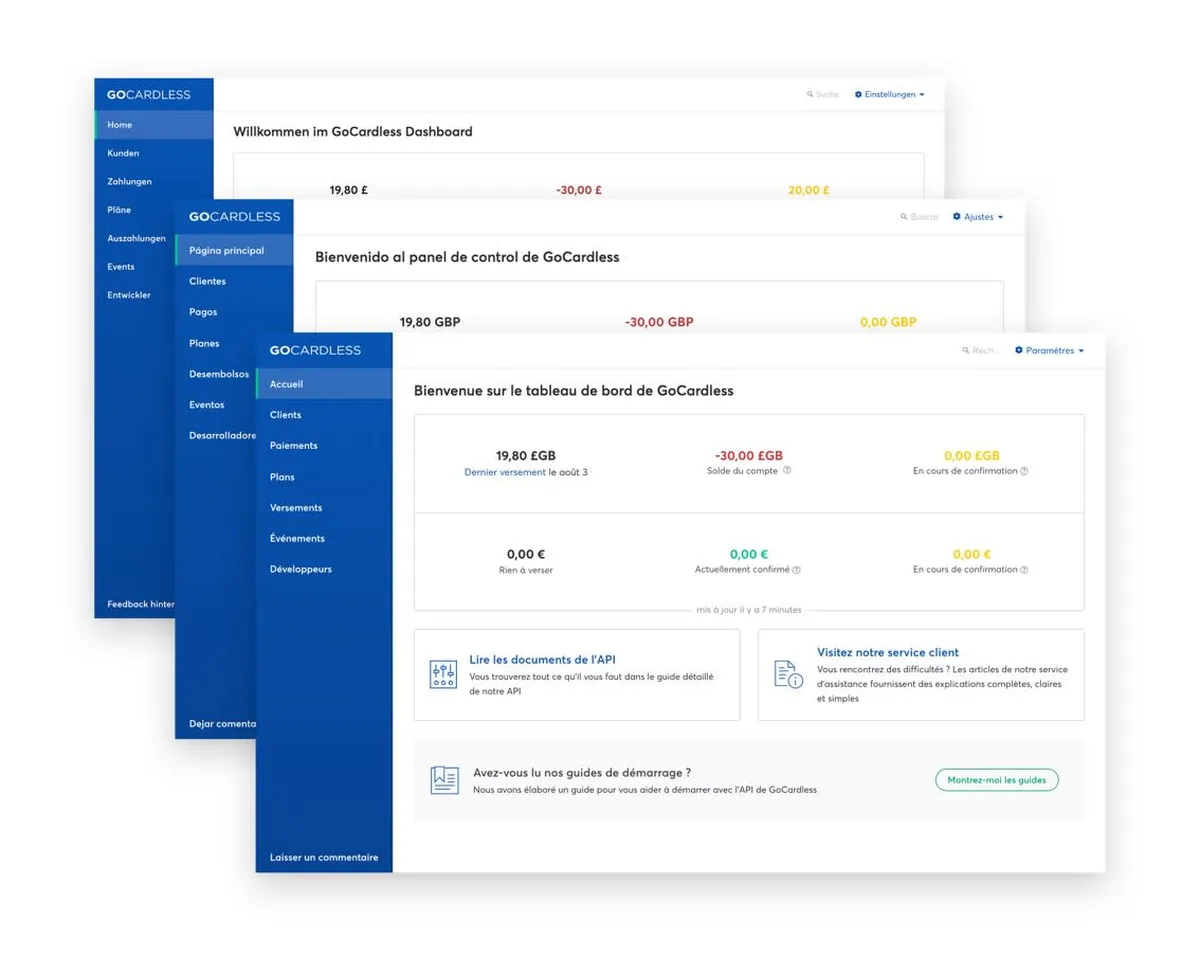

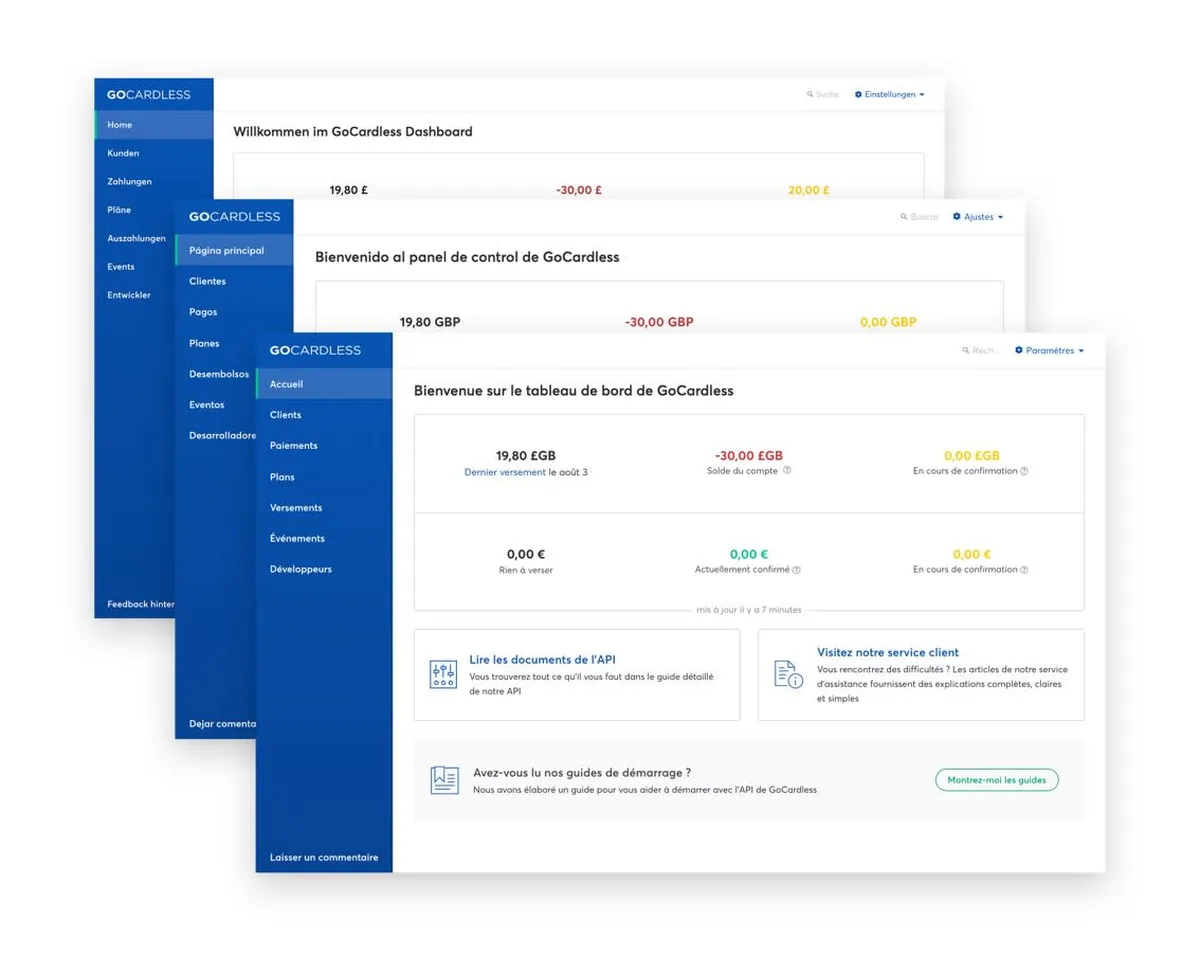

This application software supports the following languages : English, German, Spanish, French, Portuguese, German, Dutch, Portuguese, French …

Support & Training

Any problem with this computer program ? The vendor offers the following customer service & support to help teams get the most out of their business application : 24/7 Live support, Chat, Email / Help Desk, FAQs / Forum, Knowledge Base, Phone Support, Online Support …

Hotline : Yes

Training options : Documentation, Webinars …

Industry & Customers

Who use GoCardless ?

This software package is tailored to business needs : Small and Medium companies, Medium companies (Turnover : – $50 million) in countries like USA …

This web-based application is recommended for trades : Administrative, Accounting, Finance, Sales …

This cloud software is used in the sectors : Software, Information Technology and Services, Accounting …

Customer References

Testimonials & Customer References to decide if this is the right business software or service for your company : Koala Tlcom, Payfit, Wikimedia France, Habitat, Cassiopaie, Oosto, Digidom …

Awards & Recognitions

No information .

Screenshots

This computer program has an ergonomic, intuitive and customizable user interface, which will improve team productivity and collaborative work within your company (Small Company, SME, Startup …)

GoCardless Screenshots & Images : UI, dashboard …

GoCardless Business Software Pricing

GoCardless Features & Overview

GoCardless Screenshot

GoCardless Screenshot

Videos

Video #1

Video #2

GoCardless Reviews

Here is our opinion on GoCardless : this is a very popular online payment software to advise .

GoCardless User Reviews & Ratings

Online and customer reviews of GoCardless software are quite plentiful and overall very positive :

Overall rating : 4,4/5

Value for money : 3,9/5

Functionality : 3,5/5

Usefulness : 3,9/5

Ease of use : 3,9/5

User rating Excellent : 71%

User rating Very Good : 11%

User rating Average : 2%

User rating Poor : 1%

User rating Terrible : 16%

Low prices for everyone

Popularity on social networks : 34434 followers on LinkedIn

Your Customer Review on GoCardless

What is your opinion about this app ? Submit your review and tell us about your overall opinion : experience with this SaaS software, rating, ease of use, customer service, value for money, Pros & Cons …

Customer reviews and feedbacks play an increasingly important role in the business software buying process. You can provide in-depth review and share your buying advice / reviewer sentiment : what is your likelihood to recommend GoCardless ? What is your likelihood to renew ?

FAQs

Why use a Online Payment Software ?

Online payment software makes it possible to accept online payment via a bank card.

According to various sources, most used business software are : PayPal (market share : 72,10%), Square (27,20%), Stripe (9,40%), Fiserv (8,30%), Amazon Payments (3,20%), Adyen (2,20%), Merchant e-Solutions (2,00%), Kyriba (1,70%), Spreedly (1,60%), Braintree (1,50%), UFN (1,40%), Zen Cart (1,10%), Login-and-Pay-with-Amazon (1,00%), Vanco-Payment-Solutions (1,00%), Klarna (0,70%), Virtuemart (0,70%), Cybersource (0,60%), Ubercart (0,60%), Google Checkout (0,60%), Bill-Me-Later (0,20%)

Main functions are : Online payments, e-commerce support, POS transactions, Gift card management, Customer management, Regular payment

Main characteristics are : Online payment, Security by SSL, Automatic invoicing, Notification system, Creation of e-commerce site, Management of customers and subscribers, Sales of digital files, Payment by e-mail, Sale by subscription, Unlimited payment pages, FinTech, Finance, Online payment, Collect without counting, Accept all types of payment, Synchronize and export your data, send your receipts, Fintech, SAAS software, Social and Solidarity Economy – eSS, Online payment, Payment, Btob, Btoc, FinTech, Finance, Payment methods, Online payment, Online payment, Payment

Online Payment Software Average Price : from $ 10,00 to $ 160,00 with an average price of $ 69,50 . We have identified more than 226 competitors on the market.

Online Payment Software Review

Company details

Developed by GOCARDLESS, Inc. (@GoCardless on Twitter)

HQ location : United Kingdom

Founded in 2011 by Hiroki Takeuchi

Total revenue :

Fundings : Û 17_000_000

Industry : B2B SaaS company

Software Category : Payment Software > Payment Processing Software > Online Payment Software

Schema : SoftwareApplication > BusinessApplication

Tags : Fully Customizable Integration | Conversion rate reduction | Conversion rate improvement | Cash flow improvement | Collection of payments | Account creation in minutes | Customer database import | Saving time on administration | Automation of payment collection | FinTech …

Website : visit gocardless.com

About This Article

This page was composed and published by SaaS-Alternatives.

The information (and product details) outlined above is provided for informational purposes only. Please Check the vendor’s website for more detailed information.

Our opinion on GoCardless is independent in order to highlight the strengths and weaknesses of this Online Payment Software. Our website is supported by our users. We sometimes earn affiliate commission when you click through the affiliate links on our website.

GoCardless Alternatives

If you’re understanding the drawbacks and you’re looking for a GoCardless alternative, there are more than 27 competitors listed on SaaS-Alternatives !

If you’re in the market for a new software solution, the best approach is to narrow down your selection and then begin a free trial or request a demo.

Compare GoCardless Pricing Against Competitors

| Software | Starting Price | Billed | Free Trial |

| GOCARDLESS | $ | Per month / user | Yes |

| SQUARE 9 GLOBALSEARCH | $ | Per month / user | No |

| ADYEN | $ | Per month / user | No |

| CHARGEBEE | $249 | Per month / user | No |

| PAYPAL | $ | Per month / user | No |

| STRIPE BILLING | $ | Per month / user | No |

| GENOME WALLET | $ | Per month / user | No |

| PAYU | $ | Per month / user | No |

| GETTRX | $29 | Per month / user | No |

| CLOVER | $ | Per month / user | No |

Top 10 Alternatives & Competitors to GoCardless

– Bill

– Recurly

– Fusebill

– Chargebee

– Zoho Subscriptions

– Payfacile

– Iraiser

– Slimpay

– Spendesk

– Mangopay

SaaS alternatives

Stripe : Stripe makes it easy for developers to accept credit cards on the web.

SlimPay : It enables merchants to facilitate purchase, increase consumer lifetime value and maximize revenue through direct debit and card payments.

PayPal : PayPal is an online money transfer and payment service that allows you to send money by email, phone, SMS or Skype. They offer products to individuals and businesses, including online sellers, auction sites, and businesses. PayPal effortlessly connects to bank accounts and credit cards. PayPal Mobile is one of PayPal’s newest products. It allows you to send payments via SMS or using PayPal’s mobile browser.

Adyen : A payment technology company that provides a single global platform to accept payments anywhere in the world. Businesses can process online, mobile, and in-store (POS) payments with more than 250 payment methods and 187 currencies.

Braintree : Braintree replaces traditional payment gateways and merchant accounts. From instant payments to mobile SDKs and international sales, we’ve got everything you need to start accepting payments today.

You can also take a look at other business apps, like our Spiff review and our Soldo review.

Comparison with Similar Software & Contenders

Take an in-depth look at popular Payment Software and Payment Processing Software to find out which one is right for your needs. Discover how these Online Payment Software compare to GoCardless when it comes to features, ease of use, customer support and user reviews. Explore software, Compare options and alternatives, Read reviews and Find your solution !