Lendstream

Lendstream : Reviews, Pricing, Features & AlternativesLendstream is a Mortgage Software. Price : $99 (free trial available). Review Lendstream : Overview & Pricing

Lendstream Overview : Features, Pricing, Reviews & Alternatives

Lendstream is a Mortgage Software intended for businesses. Let’s discover user reviews, features and prices of this business app.

Lendstream is listed as a Mortgage Software and Finance Software for companies and is used for Mortgage, Commercial Loan, Loan Origination, Loan Servicing …

Lendstream price starts from $ 99 per user and per month (free trial available).

Loan origination and management software for lenders and brokers.

Technological partners for the credit industry

What is Lendstream ?

Lendstream lending software has been developed for commercial, consumer, residential, p2p and other securitized and non-securitized lenders and supports many types of lending products. Lendstream can be implemented quickly and cost-effectively, enabling new product launches within 24 hours. Online analysis of production trends, product competitiveness and business growth trends. Your clients can experience the benefits of paperless loans. Transparency and flexibility in the loan service depending on the personal financial situation.

How LENSTREAM software could be beneficial: – Web and mobile applications allow to remotely identify customers and collect KYC data; – All business management processes can be automated from 1 to 100%. – Real-time monitoring: More than 100 predefined reports available immediately to monitor activities. – Easy to adapt to changing business needs.

The main advantages of the loan software are: – Rich and customizable (easy to modify parameters, products and prices, workflows); – Multi-tenant (multi-country and office, multi-currency and language, white label ready); – REST-based API (open API to expose all data, integrations with third-party data or service providers); – Analysis (Schema-less data API and report generator, data export, .pdf, .xls, .csv formats; predefined, custom and scheduled reports); – Scalable and secure (cloud-based, EU GDPR and PSD2 compliant, role-based security);

For our prospects, we offer a solid system or separate modules: – Loan creation and management module, with biometric identification of the borrower, notation, electronic signature and other functionalities; – Partner network management module (broker); – Secondary marketing module (loan portfolio commitments, sales); – Functionality of the crowdfunding platform;

Lendstream is the software provider for the lending industry. Lendstream’s origins date back to 1998, when a group of IT experts began creating a loan management system for the Baltic-American Enterprise Fund (the first NBFI in the Baltic States). Our product is the result of intense teamwork with loan officers, loan department and legal staff, loan and ROE brokers, real estate agents and sellers. Our lending software can be API-integrated with third-party data or service providers in any market, enabling a single business management system for multinational operations. The easy configuration of products and workflows is the perfect tool to achieve the desired level of automation at every point of the loan origination and servicing process.

Integrated API-driven loan origination and service management software with additional secondary marketing (loan portfolio sales) and partner channel management options. Our loan software is designed for SMEs, mortgages, consumers, micro-credit, leasing, loan brokers and crowdfunding platforms. API integrations with third-party data or service providers, built-in multilingual and multicurrency solutions, and configurable workflows allow one system to be used in multiple markets. Lendstream loan management software was developed by a dedicated team of loan management and technology experts with over 15 years of experience. It supports the following business cases: loan origination and management; loan brokerage services; Ready as a service; Fundraising.

Lendstream Review : Pros & Cons

Pros & Cons

When it comes to finding the right Mortgage tools to manage your business, you have too many options – and they all come with their strengths and weaknesses.

One such familiar name in this arena is Lendstream, and as you may have guessed from the title, this review will tell you more about Lendstream’s pros and cons.

Weighing the pros & cons is essential before selecting this tool for your business and your team.

Lendstream Pros : Key Benefits

– Integrated loan management software could launch in weeks with clear installation and support costs.

– Smart marriage of credit products.

– Automated borrower/investor identification and KYC functions.

– Scheduled reports.

– Web and mobile apps for quick borrower/investor onboarding.

– Electronic signature of documents.

– Electronic or mobile signatures

– Automated credit decision.

– Sophisticated delinquency management.

– Customizable workflows, 1-100% process automation

Lendstream Cons

– Con : Custom integrations can come at a price.

Lendstream Features

Here is the list of the main features of this computer software :

– Audit Trail

– API

– Workflow Management

– Accounting

– Collaboration

– Activity Tracking

– Document Management

– Alerts/Notifications

– Mobile Access

– Amortization Schedule

– e-Signature

– Application Management

– Chat (Messaging)

– Approval Process Control

– Audit Trail

– Auto Loans

– Automated Decisioning/Underwriting

– Automatic Funds Distribution

– Borrower Management

– Business Loans

Main function & Pro Features

– Audit Trail

– API

– Workflow Management

– Accounting

– Collaboration

– Activity Tracking

– Document Management

– Alerts/Notifications

– Mobile Access

– Amortization Schedule

– e-Signature

– Application Management

– Chat (Messaging)

– Approval Process Control

– Audit Trail

– Auto Loans

– Automated Decisioning/Underwriting

– Automatic Funds Distribution

– Borrower Management

– Business Loans

Lendstream Integrations

Lendstream may integrates with applications & plugins : database connection, synchronize data, share files (…) to improve your workflow and increase your productivity !

It also provides a powerful API toolkit that allows developers to build web services and exchange data.

Lendstream Pricing

The Lendstream pricing plan starts from $ 99,00 per month and per user, but this price is likely to change because different options are offered by the developer : number of licenses, additional functions, add-ons, bundles …

Lendstream offers several pricing plans :

– Lendstream : $ 99,00 per user / per month

– Start : –

– Professional : –

– Enterprise : –

– Premium : –

| Lendstream | Start | Professional | Enterprise | Premium |

| $99,00 | – | – | – | – |

| Per month | Per month | Per month | Per month | Per month |

| Per user | Per user | Per user | Per user | Per user |

Save $$$ on SaaS and on-premise Software Subscriptions to help your create, grow and scale your business : annual billing usually is cheaper than monthly billing and you can expect 10% to 20% discount.

Sign up for a trial and start using it right away !

Free trials usually are time limited or feature limited but this is a good way to ensure it is the right option for your business before making a purchase.

Screenshot of the Vendor Pricing Page :

Software Pricing Plans

Pricing Details

Pricing Model : Subscription

Free trial : Yes : 30 days

Free plan : Premium only

Freemium : No information

Starting price : $ 99,00

Entry-level set up fee : No setup fee

The pricing details were last updated this year from the vendor website or retrieved from publicly accessible pricing materials and may be different from actual. Please confirm pricing and deals with the vendor website before purchasing.

Deployment & Setup

Lendstream is a cloud-based Mortgage platform : its infrastructure is hosted in the United States (probably on AWS, Microsoft Azure or Google Cloud Platform).

lendstream is a SaaS (Software as a Service) / web application : a web browser on a computer is required for full functionality of features and manage dashboard.

It supports desktop operating systems (like Windows …).

Technical Details & Specifications

Deployment : Cloud / SaaS

Desktop Operating Systems : Windows …

Mobile Platforms : –

Native Apps / Mobile Applications : –

GDPR compliance : No information

Supported languages

This application software supports the following languages : English, Russian, Russian …

Support & Training

Any problem with this computer program ? The vendor offers the following customer service & support to help teams get the most out of their business application : 24/7 Live support, Chat, Email / Help Desk, FAQs / Forum, Phone Support, Online Support …

Hotline : Yes

Training options : Documentation, In Person, Live Online, Videos, Webinars …

Industry & Customers

Who use Lendstream ?

This software package is tailored to business needs : Entrepreneur, Medium Company, Large Company …

This web-based application is recommended for trades : Professional …

This cloud software is used in the sectors : Services …

Customer References

Testimonials & Customer References to decide if this is the right business software or service for your company : No reference …

Awards & Recognitions

No information .

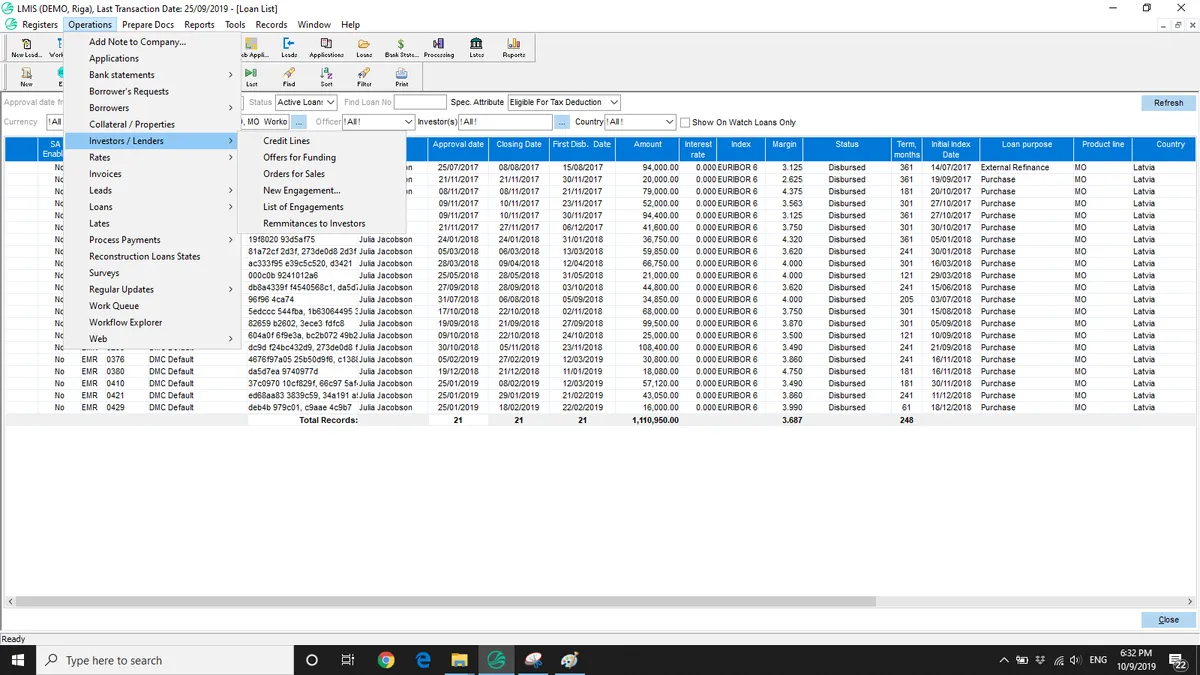

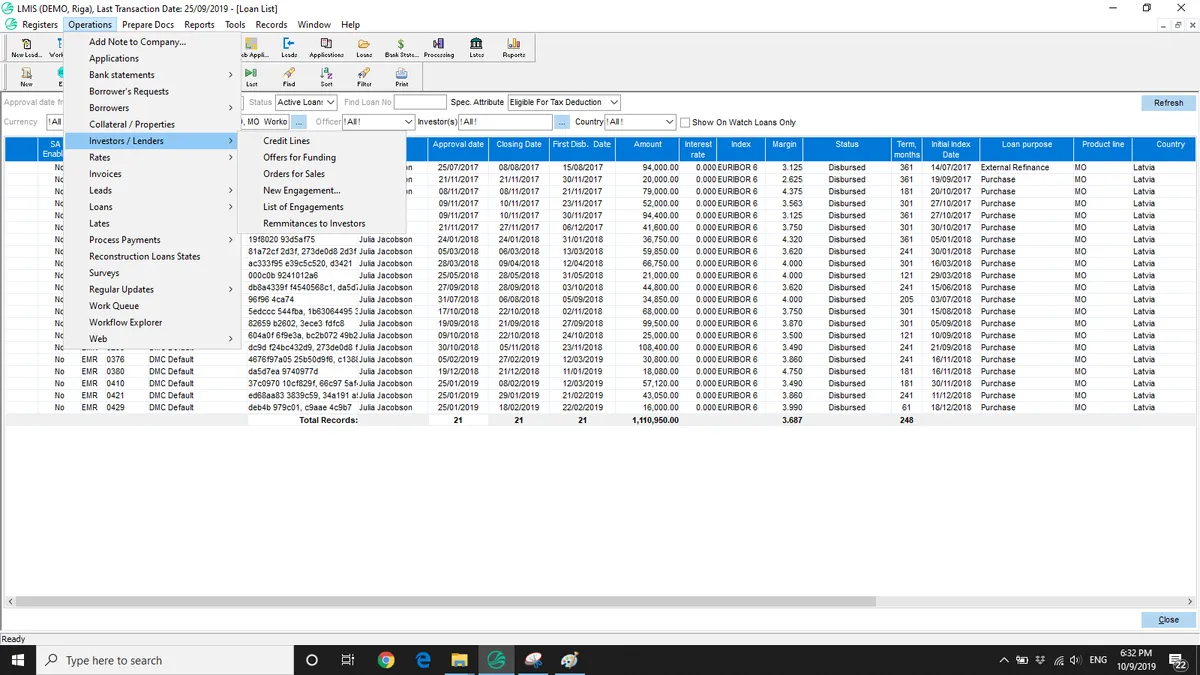

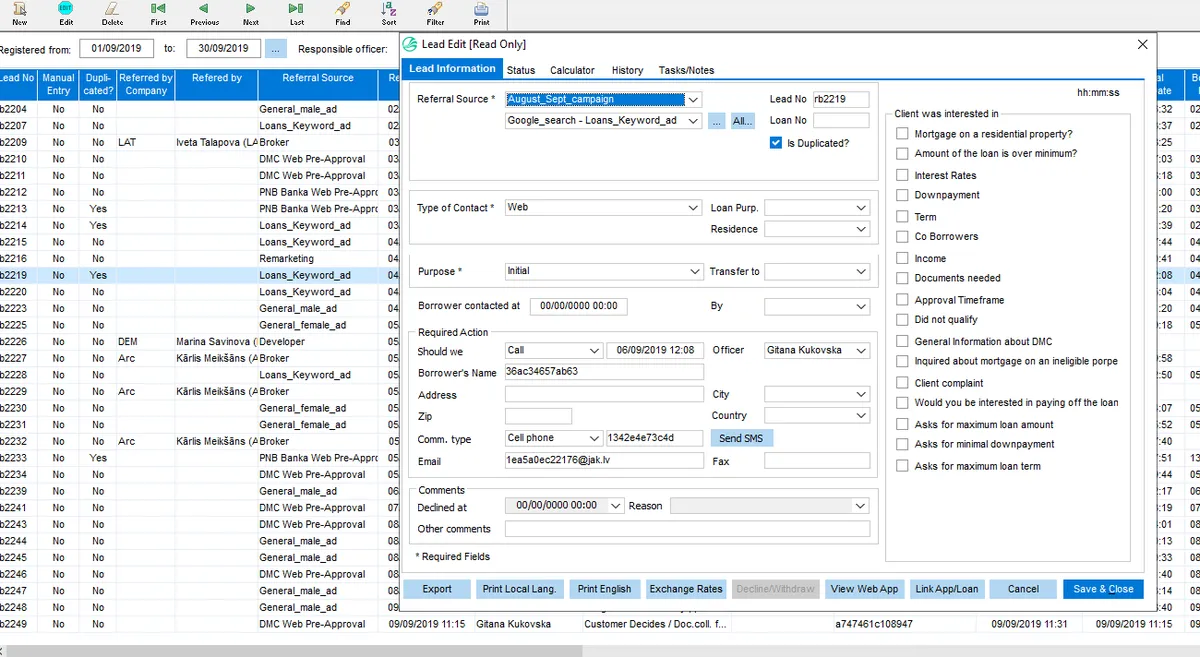

Screenshots

This computer program has an ergonomic, intuitive and customizable user interface, which will improve team productivity and collaborative work within your company (Entrepreneur, Freelancer, Large Company …)

Lendstream Screenshots & Images : UI, dashboard …

Lendstream Business Software Pricing

Lendstream Features & Overview

Lendstream Screenshot

Videos

This video is no longer available

Lendstream Reviews

Here is our opinion on Lendstream : this is an excellent mortgage software to advise .

Lendstream User Reviews & Ratings

Online and customer reviews of Lendstream software are quite plentiful and overall very positive :

Overall rating : 4,6/5

Value for money : 4,9/5

Functionality : 4,7/5

Usefulness : 4,9/5

Ease of use : 4,9/5

User rating Excellent : 10%

User rating Very Good : 90%

User rating Average : 0%

User rating Poor : 0%

User rating Terrible : 0%

Excellent loan mounting system

Popularity on social networks : 145 followers on Twitter

Your Customer Review on Lendstream

What is your opinion about this app ? Submit your review and tell us about your overall opinion : experience with this SaaS software, rating, ease of use, customer service, value for money, Pros & Cons …

Customer reviews and feedbacks play an increasingly important role in the business software buying process. You can provide in-depth review and share your buying advice / reviewer sentiment : what is your likelihood to recommend Lendstream ? What is your likelihood to renew ?

FAQs

Why use a Mortgage Software ?

Loans software (loans – mortgages) makes it possible to manage the loans and loans granted to customers and suppliers.

Main functions are : Loan follow-up, Accessibility 24-14, Import – Export data, Business management, CRM

Main characteristics are : Software is available over the Internet, application is maintained by the vendor, license to the software may be subscription based or usage based.

Mortgage Software Review

Company details

Developed by CREDITI RIVUS, JSC, Inc.

HQ location : Lithuania

Founded :

Total revenue :

Industry : B2B SaaS company

Software Category : Finance & Accounting Software > Finance Software > Mortgage Software

Schema : SoftwareApplication > FinanceApplication

Tags : …

Website : visit lendstream.io

About This Article

This page was composed and published by SaaS-Alternatives.

The information (and product details) outlined above is provided for informational purposes only. Please Check the vendor’s website for more detailed information.

Our opinion on Lendstream is independent in order to highlight the strengths and weaknesses of this Mortgage Software. Our website is supported by our users. We sometimes earn affiliate commission when you click through the affiliate links on our website.

Lendstream Alternatives

If you’re understanding the drawbacks and you’re looking for a Lendstream alternative, there are more than 16 competitors listed on SaaS-Alternatives !

If you’re in the market for a new software solution, the best approach is to narrow down your selection and then begin a free trial or request a demo.

Compare Lendstream Pricing Against Competitors

| Software | Starting Price | Billed | Free Trial |

| LENDSTREAM | $ | Per month / user | No |

| FLOIFY | $49 | Per month / user | Yes |

| LENDINGPAD | $40 | Per month / user | No |

| LENDFOUNDRY | $ | Per month / user | No |

| CREDITCORE | $ | Per month / user | No |

| INFLOOENS | $ | Per month / user | No |

| MORTGAGE BUILDER | $ | Per month / user | No |

| DECISIONLENDER | $ | Per month / user | No |

| LENDINGWISE | $ | Per month / user | Yes |

| ENCOMPASS | $ | Per month / user | No |

Top 10 Alternatives & Competitors to Lendstream

– MortgageFlexOne

– Turnkey Lender

– FileInvite

– Bryt

– HES Lending Platform

– Encompass

– CloudBankIN

– BNTouch Mortgage CRM

– ESDS

– Turnkey Lender

Free Alternatives to Lendstream

– Lendesk

You can also take a look at other business apps, like our InclusiveDocs review and our QVALON review.

Comparison with Similar Software & Contenders

Take an in-depth look at popular Finance & Accounting Software and Finance Software to find out which one is right for your needs. Discover how these Mortgage Software compare to Lendstream when it comes to features, ease of use, customer support and user reviews. Explore software, Compare options and alternatives, Read reviews and Find your solution !